Is Prosper Trading Academy a Scam?

Are you looking for a way to build a sustainable income stream? Look no further than digital real estate.

Scott Bauer is a trading guru who has appeared on CNBC, Fox Business, and the TD Ameritrade Network. He teaches a simple strategy that can generate explosive profits with minimal risk. Is Prosper Trading Legit? To learn more, read the article below.

What is Prosper?

Prosper is a peer-to-peer (P2P) marketplace that allows consumers to borrow money directly from strangers. The platform matches creditworthy borrowers with individuals looking to invest in their loans. Its services are available online and on mobile devices. Founded in 2005, Prosper has facilitated over $12 billion in loans for more than 770,000 borrowers. Prosper offers borrowers personal loans for debt consolidation, home improvement, vacations, vehicle purchases, and other purposes. It offers fixed rates and terms for borrowers and charges a service fee to investors.

To apply for a loan on Prosper, users must provide basic contact information and some financial details. If their application is approved, they will receive funds through direct deposit within one to three business days. If necessary, Prosper may request additional supporting documentation, such as pay stubs or tax returns.

The company uses a proprietary scoring system to rate prospective borrowers and determine whether to approve or reject their loan requests. It also verifies the borrower’s identity and conducts a hard inquiry on their credit report to confirm the accuracy of their loan application. Once the loan has passed any required verification, it can be approved and funded by investors who choose to buy “notes” on the platform.

After a loan is approved, the lender will receive monthly payments from the borrower, which are comprised of principal and interest. Each payment is deposited into the investor’s Prosper account, and they can choose to reinvest their payments or withdraw them. In addition, if the loan is repaid before its original term, the investor will receive a higher return on their investment.

While many investors find Prosper an attractive investment opportunity, it is important to consider the risks before investing. In addition to the potential loss of principle, investors should understand that lending through Prosper is not insured or guaranteed by the federal government. Investors are therefore responsible for the full amount of their investment if the borrower fails to repay the loan.

In 2008, Prosper was the subject of a class action lawsuit brought by investors who purchased loans through the site from January 1, 2006, to October 14, 2008. The plaintiffs claimed that Prosper violated California and federal securities laws by offering unregistered and unlicensed securities. The lawsuit sought damages, the right to rescission, and class certification.

How does Prosper work?

Prosper is a peer-to-peer lending platform that connects people with money to lend to people who need it. When borrowers pay back their loans, investors earn a profit on the amount they invested. Prosper makes its money from transaction and servicing fees charged to both borrowers and investors.

Prosper has an excellent track record of delivering positive returns to its investors. Since the company relaunched its website in mid-2009 (after the financial crisis forced it to close), every portfolio with exposure to more than 100 individual loans has earned a positive return. While past performance doesn’t necessarily predict future results, it is an encouraging sign that Prosper has found a successful formula for connecting borrowers and lenders.

Borrowers pay an origination fee to Prosper of 1.00% to 5.00%, depending on their Prosper rating. This fee is passed on to investors, who also pay a 1% annual servicing fee. Prosper uses a high-tech system to match borrowers and investors based on their credit profile, income, debt-to-income ratio, and other factors. The site’s information-dense listings provide a wealth of detail about each loan, including the principal size, term, borrower rating, and estimated default risk.

Investors can choose to invest in notes, which represent shares of individual loans. The minimum investment is $25, and you can purchase notes in groups of 25, 50, or 250. If a loan fails to originate, Prosper returns the funds you invested in it, and you can redistribute your investment to other loans.

If you choose to remit your monthly payment via check, Prosper charges a fee equal to the lesser of $15 or 5 percent of your monthly payment amount. Also, if you miss a payment, Prosper will charge a late fee of $15 or 5% of the unpaid balance, whichever is greater.

If you are looking for a way to make extra cash from home, then Scott Bauer’s Prosper Trading Academy may be the answer for you. His course teaches students how to trade stocks using strategies that are easy to understand but highly effective at turning profits. He has appeared on Fox Business, CNBC, and Bloomberg TV to share his knowledge with other traders.

Is Prosper a scam?

Prosper is one of the oldest peer-to-peer loan companies in the US. It offers personal loans and marketplace lending for borrowers to connect with lenders and investors who can meet their borrowing needs. The company provides a safe and trusted platform for the entire process, from application to funding. The loans are unsecured and have a fixed interest rate and term. Borrowers can use the funds from a Prosper loan for a variety of purposes, including debt consolidation, home improvements, and vacations. The company also offers an investment option where investors can earn a return on their investments in exchange for providing capital to borrowers.

The company has an excellent track record with borrowers and investors, and it is backed by reputable financial institutions. However, there are some negative reviews on the website from borrowers who have experienced problems with the service. Some of the complaints focus on technical issues, such as auto-payments being enabled without their consent or inaccurate monetary transactions. Others describe poor customer service and lengthy approval processes.

In addition to the standard lending fees, Prosper charges a processing fee, which is deducted from the principal before it is released to you. This fee is similar to the origination charge that banks charge when you apply for a mortgage or car loan. The company also charges a late payment fee and a check processing fee.

The loan amount that you borrow is subject to a minimum credit score of 640, and the terms and conditions are flexible. You can choose to repay your loan in installments over a maximum of five years, and you can also prepay your principal at any time without penalty. The company also reports your monthly payments to the three major credit bureaus.

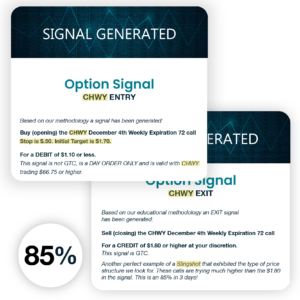

Prosper also offers a trading academy that offers video courses on a wide range of topics, from investing basics to advanced strategies. Its coaches include a former professional trader, Scott Bauer, who has appeared in various media outlets. The academy’s programs are designed to help traders build their skillset in their current asset class while also expanding into new ones.

Is Prosper Trading Academy a Scam?

There are a lot of things that can go wrong with any kind of financial trading product. That being said, Prosper Trading Academy is not a scam. You can make money from it, but you have to be willing to put in a lot of work and know that you will take a lot of risks.

The Academy offers a variety of courses that can help you learn how to trade stocks. Its courses are designed to teach you how to use technical analysis and identify market opportunities. It also provides live market data and access to experienced traders. The academy also offers mentoring services.

Mike Shorr is a derivatives trader with experience at the CBOT, CBOE, and CME exchanges. He teaches options trading at the Prosper Trading Academy. He focuses on short-term options strategies that can be used by novice traders to achieve consistent profits. His teaching style is engaging and keeps students engaged throughout his courses.

One customer complained that the company called truck drivers and asked them to pay thousands of dollars over the phone for “trading education.” The customer said that all of their recommended trades were losses and that flipping a coin would have given a better return. Another customer said that he signed up for the course but was disappointed that it wasn’t as effective as advertised.

The Prosper Trading Academy has a high number of positive reviews, but many of them are from unreliable sources. While it may be a legitimate program, you should always consider your options before committing to any program. It is important to remember that there are no guarantees when it comes to trading, and even a highly successful teacher can have a bad day. That being said, the Prosper Trading Academy is definitely worth a look if you are interested in learning how to trade stocks. Just be sure to do your homework before signing up for a course. This will help you avoid any scams or pitfalls that may be lurking in the background. Good luck!